LE: Record number of projects in U.S. construction pipeline

Hotel Business

OCTOBER 28, 2024

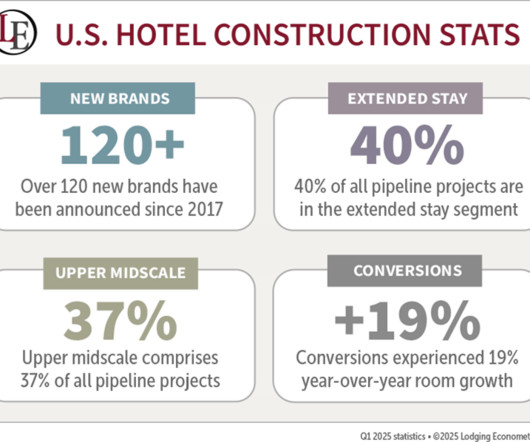

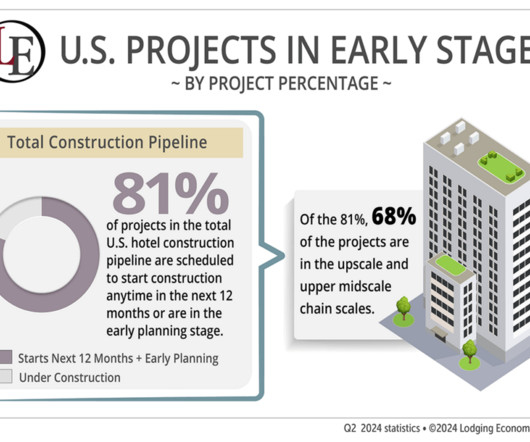

LE analysts report that the upper-midscale chain scale continues to have the largest project count in the U.S. The upscale chain scale follows with 1,407 projects/174,127 rooms. Together, these two chain scales comprise 60% of all projects in the total pipeline. supply increase. supply increase.

Let's personalize your content