CBRE Releases 2024 U.S. Real Estate Outlook

Lodging

DECEMBER 14, 2023

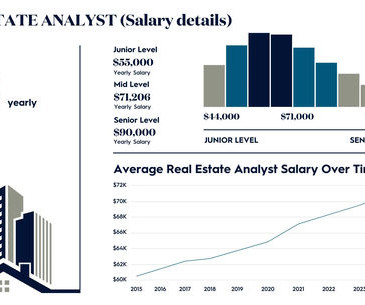

DALLAS, Texas—CBRE foresees economic growth slowing in 2024, though a recession may be avoided and real estate transaction values will decline further, creating compelling buying opportunities, according to the company’s 2024 U.S. Real Estate Outlook. Real Estate Outlook appeared first on LODGING Magazine.

Let's personalize your content