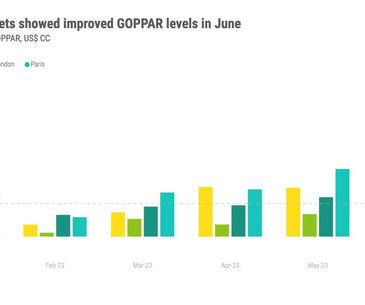

CBRE: Commercial Real Estate Lending Market Shows Stabilization

Lodging

FEBRUARY 20, 2024

DALLAS, Texas—The commercial real estate lending market demonstrated signs of stabilization at the end of 2023, with borrowing costs appearing to have peaked, even as transaction activity remains subdued, according to the latest research from CBRE. percent from Q3 2023—marking the first quarterly increase since Q1 2022.

Let's personalize your content