‘Promising opportunities’: Ascott Australia MD David Mansfield’s New Zealand outlook

Hotel Management

OCTOBER 31, 2024

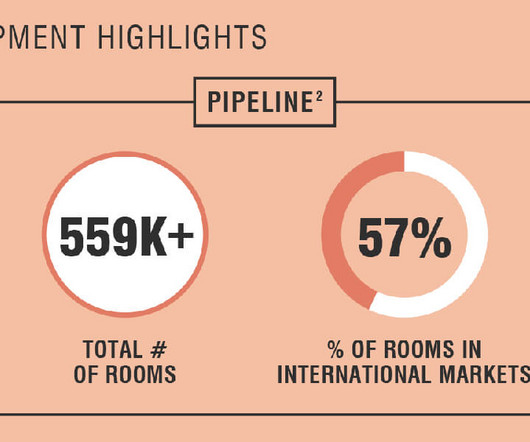

Consumer sentiment has been a bit hesitant, and we did experience a slowdown in demand during the second quarter. Our properties are performing well, with solid occupancy and rate performance. Looking ahead, we have several exciting opportunities in the pipeline.

Let's personalize your content