European Accommodation Barometer: Tracking the Rebound of Travel Sector

The Resilience of the Travel & Tourism Industry Revealed in the Fall 2023 European Accommodation Barometer

Despite the threat of inflation and a cost-of-living crisis in many countries worldwide, the results of the Fall 2023 European Accommodation Barometer further bolsters optimism among hoteliers across the continent. As a whole, the summer of 2023 has been a resounding success. Hoteliers have seen yet another 6-month period outdo the last. And for the first time since the Barometer survey began, the majority of respondents now expect their economic situation to develop positively over the next 6 months.

in the first half of 2023, the number of nights spent in European tourist accommodations reached and exceeded the pre-COVID benchmark year 2019.

In the previous survey, held before the summer season, we asked over a thousand European hoteliers if 2023 was going to be a year of record revenues: 46% concurred. This sentiment proved prescient. In September, Eurostat assessed the actual performance of the sector and confirmed that, in the first half of 2023, the number of nights spent in European tourist accommodations reached and exceeded the pre-COVID benchmark year 2019.

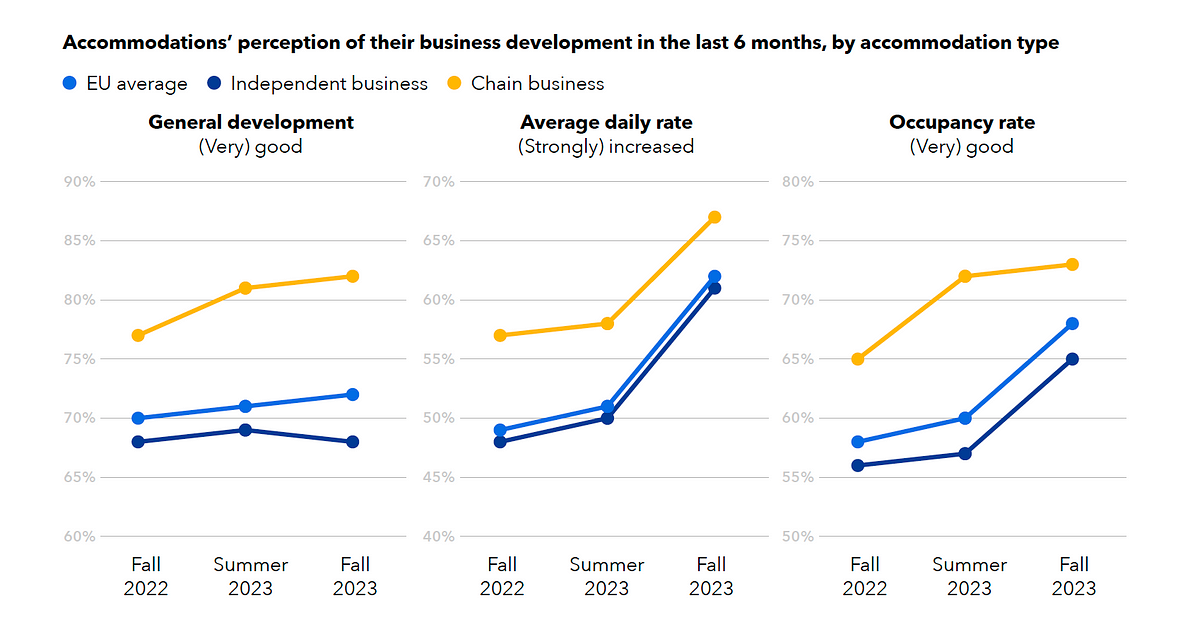

As we look back on the past 2 survey waves of the Accommodation Barometer, 7 in 10 respondents have consistently reported good or very good business developments. Although the year is not over yet, the travel and tourism sector in Europe seems likely to surpass the expectations expressed by hoteliers

With regard to business development over the past 6 months, Nordic accommodations have come out on top with 8 in 10 characterizing their summer season as good or very good — perhaps benefiting from the revival of domestic travel and those holidaymakers eager to avoid the summer’s blazing heatwaves.

Over the past 6 months, 62% of European accommodation businesses reported an increase in room rates, up 11 percentage points from the previous period.

However, the lure of sun and sand still brought plenty of tourists to the south, with Portugal and Italy just behind with 76% of respondents reporting good developments over the last 6 months. The Nordics and southern countries were also slightly more likely to say that their current economic situation was good or very good (70% or more). The only exception is Greece, which has typically performed below the European average on most economic metrics but, nevertheless, shows the most impressive upward trend across all 3 waves.

Over the past 6 months, 62% of European accommodation businesses reported an increase in room rates, up 11 percentage points from the previous period. Occupancy levels also continued their skywards trajectory, with 68% experiencing an increase and only 4% not. The survey results reflect actual occupancy rate growth — calculated by UNWTO — which has also risen steadily over the year and currently shows little sign of slowing down.

In contrast, the share of hoteliers who saw adverse developments over the past 6 months reached rock bottom at 4%

This continues to boost confidence among hoteliers: 72% characterize past developments as good or very good; and 68% view their current economic situation as good or very good. In contrast, the share of hoteliers who saw adverse developments over the past 6 months reached rock bottom at 4%. Just 5% of those we surveyed characterize the current economic situation as negative.

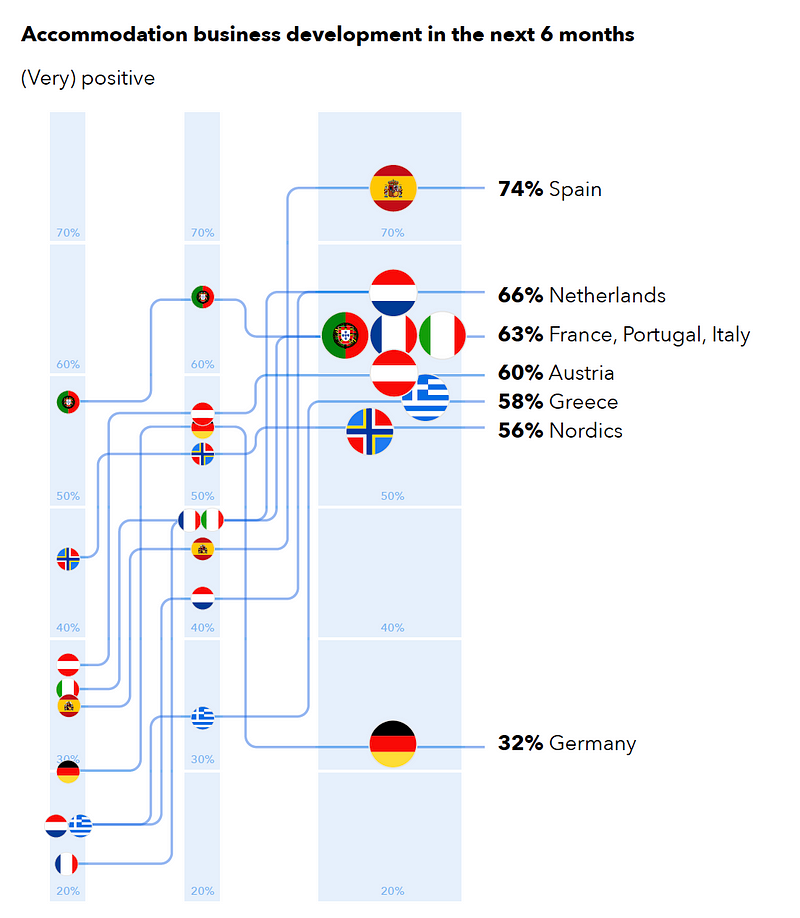

Looking ahead, the majority (59%) now believe the next 6 months will bring a positive or very positive development, pushing this number to more than half for the first time. As the summer season winds down and winter 2023/2024 commences, this year has already delivered beyond expectations.

The outliers — Germany, Austria, and the Netherlands

Hoteliers’ sentiments from Germany, Austria, and the Netherlands diverge from the overall EU trajectory, most notably from the upward trend in assessing past and current performance. While the rest of Europe posted an improvement across all 3 waves, these countries have not seen the same continuous upswing as their neighbors.

Dutch hoteliers now sit comfortably at the European average of around 70% — expressing positive sentiments toward their current and past developments. Austrians have also settled on a past development share (75%) just 3 percentage points above the average but slightly underperforming when it comes to satisfaction with their current economic situation, 63% compared to 68% of European accommodations overall.

Germany’s Barometer results, on the other hand, appear to reflect the country’s current economic woes. According to the European Commission’s latest forecast, the German economy will shrink by 0.4% in 2023. Although German hoteliers matched their EU neighbors’ assessment of past developments at 71% seeing it in a positive light, nearly half of the German accommodations we surveyed (49%) characterized their current economic situation as good or very good. On its own, this result communicates a solid sense of optimism, but not when you compare it to the 68% average across the rest of EU countries covered by the Barometer.

German hoteliers scored lower than the European average on all of the survey’s economic development metrics, including access to financing, occupancy rates, and room rate development.

German hoteliers scored lower than the European average on all of the survey’s economic development metrics, including access to financing, occupancy rates, and room rate development. The latter was the furthest from the European average at 36% vs. 62%. Optimism for continued growth remains comparatively low, with just a third (32%) of accommodations indicating that they think their business will develop positively in the next 6 months, compared to the EU average of 59%.

Chain hotels cement their ascendence in the European accommodation sector

Independent businesses are continuing to do well; and their economic development is on par with the European average. Meanwhile, chain businesses maintain a noticeable lead over smaller and independent businesses across all economic metrics: from access to financing and capital to occupancy and average daily rate development. Ultimately, 66% of independent accommodations said that their current economic situation is good or very good, compared to an impressive 75% of chain businesses.

The disparities between chain and independent businesses make it clear that chain businesses do have an economic edge over independently-managed properties, and size does matter. Bigger hotels can weather economic storms over longer periods, have more capital to leverage against loans, and can benefit from economies of scale. The latter is especially pertinent now when the costs of inputs and services are on the rise. The Fall 2023 Barometer reveals that a staggering 94% of large hotels of 250 employees or more experienced positive business development in the past 6 months and 84% saw their occupancy rate increase.

Hotels outperform short-term rentals (STRs)

Given that the size of the accommodation establishment has an impact on business sentiment, it comes as no surprise that hotels outperform STRs. In the current wave, short-term rentals lag behind across the board, with the gap being the most prominent in the development of ADRs (15 percentage points). The assessment of the current economic situation is where both accommodation types feel equally comfortable, with two-thirds of hotels and STRs sharing positive assessments.

Throughout the 3 waves, however, this gap fluctuated. In the inaugural Barometer wave, STRs’ performance was largely comparable to and occasionally exceeding that of hotels despite the gloomier future outlook. The summer wave saw hotels faring better than STRs, with the performance gap ranging between 3 and 17 percentage points. Hotels’ leads shrank slightly in the current wave but remain clearly noticeable.

Investment appetite is leveling out

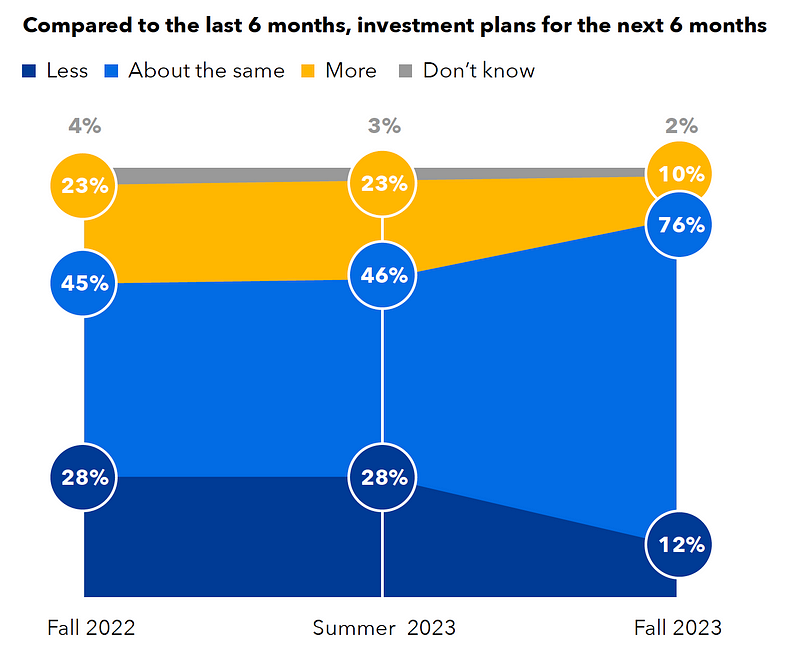

Consequently, a larger proportion of chains are prepared to invest more in their business in the next 6 months than independent properties. For both property types, the push to invest more appears to be losing steam and more hoteliers now seem to be content with their current pace of investment. Around 3 in 4 respondents (76%) now say that they will invest about the same, which is a large ramp up from less than half in the previous 2 waves. Accordingly, those indicating that they will spend more have dropped from over one-quarter (28%) to just 12%.

However, these figures do not reveal a spending retrenchment – on the contrary, the share of hoteliers intending to spend less has also shrunk to 10%. European accommodations have likely found their investment “sweet spot” after a period of pandemic-induced rapid change that necessitated additional expenditures on everything from digital upgrades to COVID-safe interior design.

Regional distinctions

On the whole, the countries covered in this report are moving along an upward trendline. The economic situation is improving, hoteliers are becoming increasingly optimistic about the future, and investment is becoming more consistent. But the picture is not uniform across the EU, and there are significant outliers.

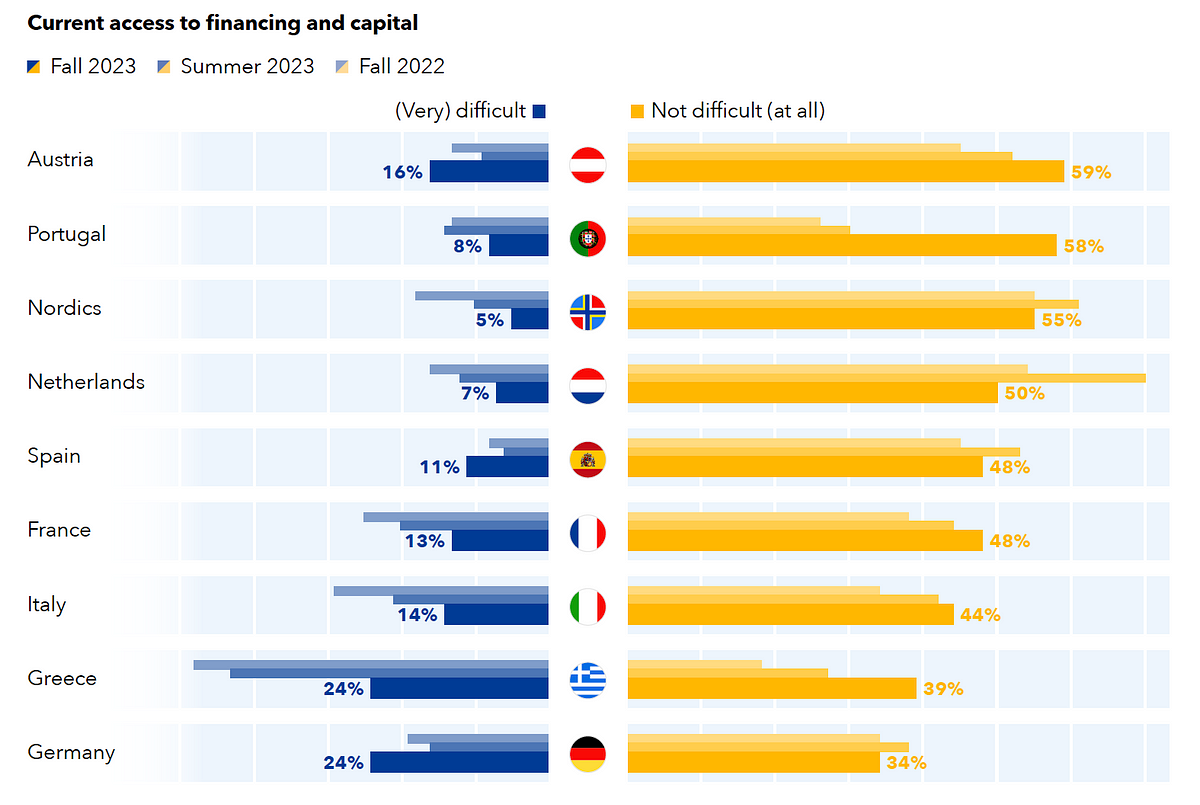

In terms of access to capital and appetite for future investments, Greek accommodations reported sentiment below the EU averages. While that applied to all three waves, it has still shown improvements from one survey to the next. In the fall 2023 wave, Greek accommodations no longer hold the last place in access to financing. 39% now convey having little to no difficulty accessing funding — only just above Germany which has fallen to the 34% mark. In this Barometer, Greece joins Spain as the top two countries which plan to continue their current level of investment (86% and 84% respectively) and are among the least likely to scale back.

Greece and other southern destinations like Italy, Spain, and Portugal reported robust ADR and occupancy rate growth. The EU average for the positive response rate in those areas reached 62% and 68% respectively, but these 4 Southern European countries averaged at an even more impressive 73% for ADR and 71% for occupancy rate growth satisfaction.

Offering local experiences (62%), attracting families (56%), and encouraging longer stays (55%) are now the top 3 opportunities for the coming 6 months.

Germany and Austria again performed below average on these metrics, while France, the Netherlands, and the Nordics sat at or slightly above average. In this wave of the Accommodation Barometer, Germany and Austria are indeed experiencing greater and more diverse challenges and were more likely to rate issues like customer acquisition, regulation, and economic uncertainty as challenges for their businesses.

Opportunities abound, but staffing challenges are growing

When asked about their greatest opportunities, European accommodations have shifted their focus slightly from the macro objective of attracting international and domestic tourism to more targeted solutions to maximize occupancy.

Offering local experiences (62%), attracting families (56%), and encouraging longer stays (55%) are now the top 3 opportunities for the coming 6 months. However, there is expected variation from country to country. Hoteliers from Europe’s number one destination for international tourists, France, continue to prioritize tourism from abroad, with 64% highlighting this as an opportunity. 77% of German accommodations, on the other hand, chose domestic tourism as their leading opportunity. Attracting Generation Z travelers was of higher interest for Greek and French accommodations, while two-thirds (76%) of Austrians saw an opportunity in sustainable products and services.

Half of European hoteliers believe government policies are important, although this has diminished from 64% in the last wave.

As the European accommodation sector returned to the pre-COVID number of room nights sold, hoteliers’ eternal priority of maximizing occupancy has reemerged in full strength. Listing on digital platforms was nominated as the most effective tool at 51% support, closely followed by offering targeted discounts (49%) and investing in esthetics (43%). Less important were the old-school mechanisms of selling rooms to wholesalers or marketing on traditional media.

At the same time, the struggle with rising costs is mounting. Energy prices continue to be a challenge that won’t go away, but the costs of staff, inputs, and services are seeing a big jump — adding to the overall financial woes. This has been particularly felt by hoteliers in Germany, France, the Netherlands, and the Nordics – presumably exacerbated by the higher minimum wage levels and the cost of living in Central and Northern Europe. These issues have undoubtedly been building with the rise in inflation in Europe. This has not only put pressure on hoteliers’ bottom line but also affects hotel workers, many of whom are in a lower wage bracket and are therefore more susceptible to increased living costs.

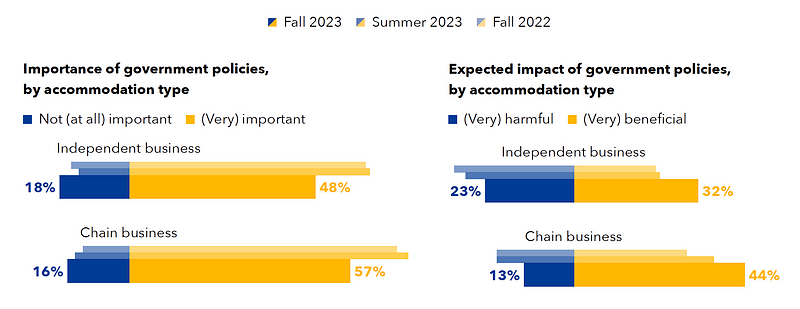

With many of these challenges related to the broader economic situation, hoteliers naturally see a prominent role for the government in supporting businesses. Half of European hoteliers believe government policies are important, although this has diminished from 64% in the last wave.

Hoteliers are now more likely to perceive government policies as beneficial (35% agreeing) as opposed to harmful to their business (21%). There is, however, a great variation among the countries, with 50% of German respondents having a negative perception of government policies compared to 59% of Nordics having a positive perception. But regardless of attitudes, investments in destination marketing were named as having the greatest potential to support the European accommodation sector. At the same time, taxation continues to be viewed as a largely negative feature of the government’s influence on accommodation businesses.

Gastronomy and hospitality go hand in hand while AI takes a back seat

Consumer demand for vegan, locally sourced, and packaging-free food and drink options is expanding. To adjust to the evolving guest preferences is to remain competitive, and European accommodations know it. This is especially important when hoteliers say that food and drink contribute to the profitability of nearly 4 in 5 accommodations (78%), with just over half conveying that it is a major contributor. Of these growing trends, hoteliers have noticed a particular rise in customers wanting sustainably/regionally sourced food options. Vegan/vegetarian options are also recognized as becoming more important by 64% of respondents, with 54% offering both options at their accommodation and 37% offering vegetarian but not vegan options.

As hoteliers appear to be focusing on the customer experience through food and beverage preferences and investment in premises, the hype behind AI is losing steam. The share of accommodations currently using AI has only increased marginally from 8% to 11% since the last survey. Yet, those planning to use AI have dropped 7 percentage points to 16%. And now 7 in 10 say that they are not considering AI use in the near future.

The European Accommodation Barometer

This third edition of the European Accommodation Barometer is based on a survey of 940 executives and managers across the European accommodation sector. It is jointly produced by Booking.com and Statista. It is representative of all European accommodations