In a move that is set to reshape the metasearch landscape, Google has announced the removal of commission-based bidding models. This shift will come into effect in April 2024 for new campaigns and October 2024 for existing campaigns. It removes a staple of the hotel industry’s digital marketing tools. This blog covers how recent changes affect hotels. We’ll outline the options to ensure your metasearch strategy remains high value and impactful.

What is commission bidding?

In commission bidding, you pay Google only when they secure a booking for your hotel. You have the flexibility to choose the commission rate, for example, 10% or 14%, and decide whether to pay for each booking or only for stays i.e. accounting for cancellations.

It has allowed hotels to pay a percentage commission post-consumption rather than upfront. This model has offered a low-risk performance-based advertising approach for many hotels.

Note: Many hotels work via with a metasearch vendor to whom they pay a CPA commission. The vendor then uses Google’s commission model in the background – either transparently or covertly. You might be using this model unknowingly.

Understanding the impact for hotels

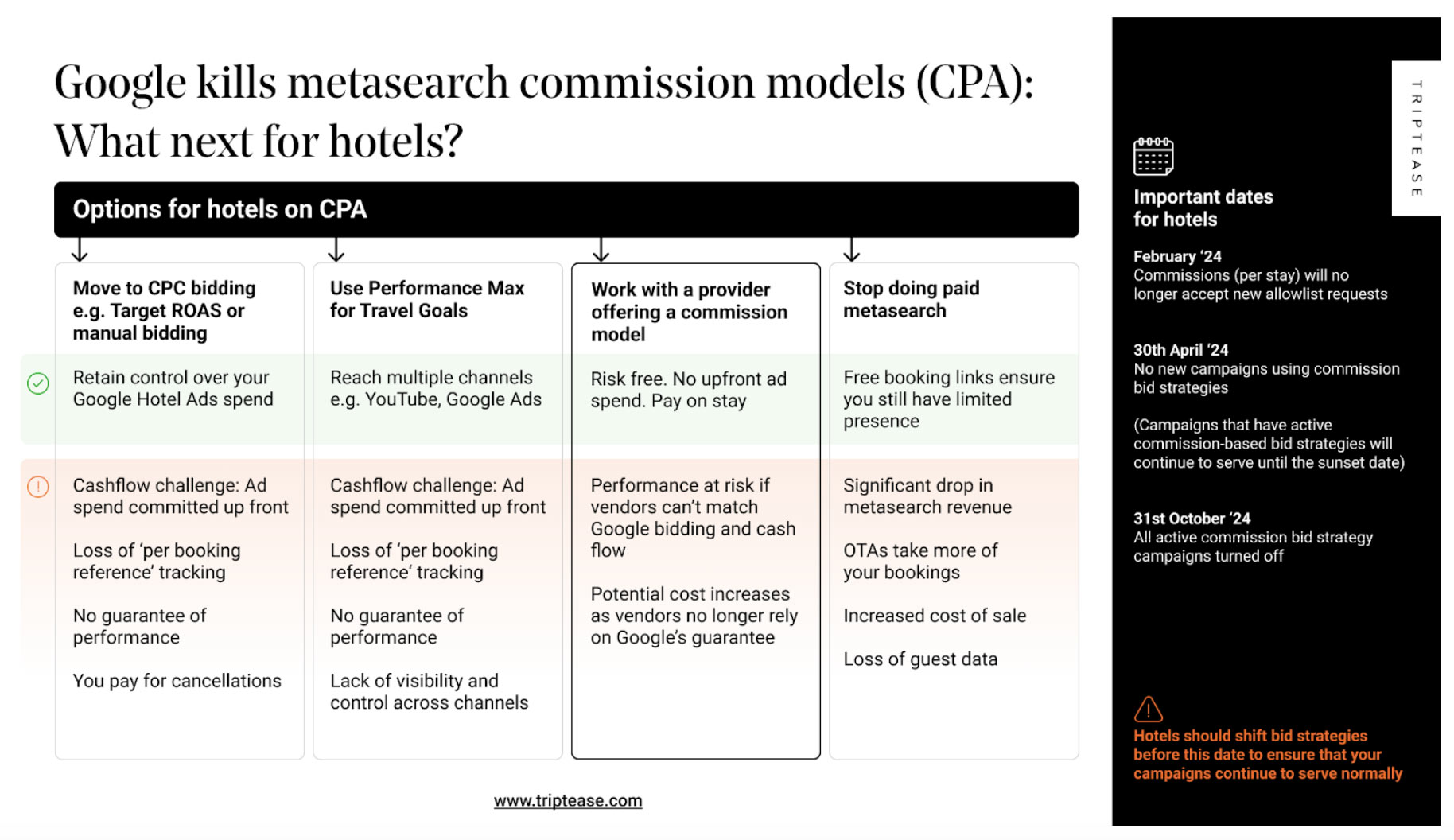

The end of commission bidding impacts hotels that rely on Google’s algorithm for bid management, charging them post-checkout/stay. Now, these hotels need to shift to alternative models which could mean:

- Upfront ad spend commitments

- Greater exposure to risks, including booking cancellations

- The need to explore other packages or providers who continue operating on a commission basis.

Why are Google making this change?

Google have said: “With upcoming changes, like third-party cookies getting phased out, we need to transition to more durable strategies to help grow your business.”

Google’s move can be seen as a standardization effort, aligning its metasearch offering with other advertising channels like paid search and display which never operated on commission models. The change also removes a barrier to adopting new products like Performance Max for Travel Goals.

How hotels should start preparing for this change

If you’re not sure whether your metasearch provider is using Google’s commission bidding model, the first step is to find out! If you are using this model you’ll need to understand what your provider’s plans to mitigate the risk are. You may even need to consider engaging with other metasearch providers who offer robust alternative to Google’s commission model.

Alternatives to Google’s CPA bidding model

Hotels now face a critical decision regarding their digital marketing strategy. Here are the primary alternatives:

- CPC-based bidding

This traditional model means up front ad spend. Hotels can manually bid or use Google’s new target ROAS, which is easier to manage but requires understanding and tracking cancellation rates to truly understand costs. - Performance Max for Travel Goals

This is a multi-channel advertising format that includes Google Hotel Ads. It provides a broader reach across Google’s channels. In its out-the-box format, it means upfront ad spend and reduced visibility/control over specific channel performance. - Work with a provider offering a commission model

Some providers, including Triptease, are still able to offer commission-based billing models, which means hotels can retain their minimal risk metasearch strategy with no upfront ad spend. - Stop doing paid metasearch

Unlike paid ads, free booking links don’t incur costs when potential customers click on them. This option relies on free booking links which ensures you still have limited presence which will also limit performance.