Skift Take

Marriott's scale and skew to slower growing segments has meant it has lagged behind its closest competitor Hilton on net unit growth for many years. Whilst its exposure to luxury historically disadvantaged growth, renewed interest in the development of luxury hotels post Covid will likely aid Marriott in bridging the unit growth gap with Hilton.

Marriott is the largest branded hotel in the world with more than 1.5 million rooms, making it 35% bigger than its closest U.S. competitor, Hilton. It has, however, grown its rooms and pipelines more slowly than Hilton for many years, with 3.2% Net Unit Growth (NUG) in 2022 vs Hilton’s 4.5%, as shown in the chart below.

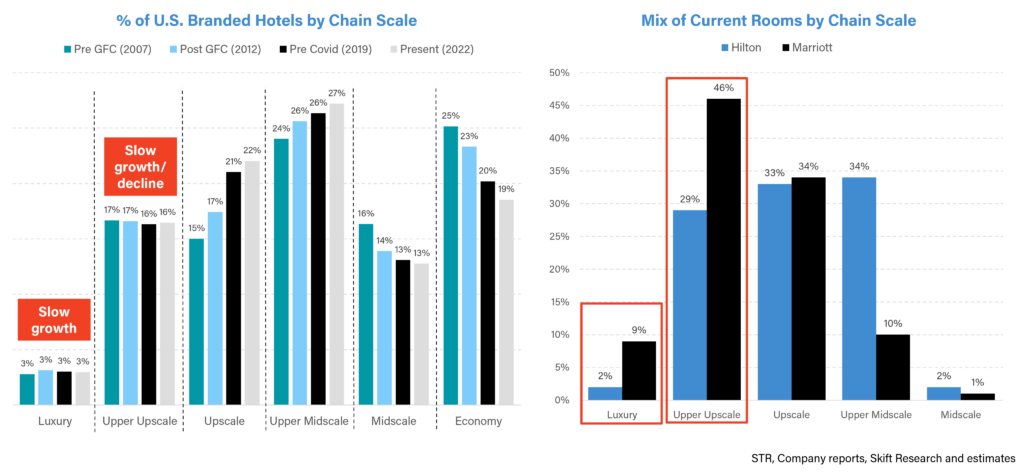

This is partly due to the law of large numbers – Marriott’s room count being materially larger than Hilton’s means that it is more difficult to sustain previous growth rates. But it is also a result of Marriott’s higher skew to chain scales that have historically grown more slowly, such as luxury and upper upscale, as shown in the charts below.

However, both companies are now going after market share in the opportunistic midscale and premium economy space – segments that have long been white spaces in their portfolios.

For example, Marriott recently bought select service midscale brand City Express and has plans to launch an extended stay midscale brand.

Hilton launched its Spark brand, which sits in the premium economy space, and also has plans to launch an extended stay brand.

Perhaps by newly tackling these opportunistic segments, we could see Marriott closing the Net Unit Growth gap between itself and Hilton – with Marriott’s scale and power of its Bonvoy loyalty program potentially attracting more owners.

Additionally, while Marriott’s higher luxury mix (with luxury accounting for 9% of Marriott’s rooms vs. only 2% of Hilton’s) has historically disadvantaged its net unit growth, the significant increase in interest from developers for luxury hotels post-Covid is now likely a benefit for Marriott.

As we have written about in depth in our report Recession Watch: Hotel Chain Scale Analysis 2023, luxury hotels rapidly recovered through the pandemic, led by strong consumer demand and material pricing growth – in turn seeing increased owner and developer interest. For example, U.S. data as of January 2023 shows that rooms under construction as a percent of current supply was the highest for the luxury hotels versus any other chain scale.

Marriott’s exposure to luxury hotels, as well as its expansion into the white space opportunities in its portfolio – namely in midscale and economy hotels – will aid future unit growth.

We explore they key comparisons between Marriott and Hilton in our handy Marriott vs. Hilton in 20 Key Charts Factbook, where we analyze the differences in NUG, segment mix and profit margins in order to aid investors and owners as we enter the second half of 2023.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: extended stay, hilton, hotel pipeline, hotels, marriott, midscale, premium economy, unit growth

Photo credit: Hotel Verte in Warsaw, Poland as part of Marriott's Autograph Collection/Unsplash