Skift Take

Travelzoo is looking to maintain fixed costs at a relatively low level as it pursues increasing the brand's presence in regional markets in Asia Pacific and elsewhere through licensing deals.

Travelzoo generated very modest revenue in the first quarter from licensing agreements it reached in Japan and Australia in 2020, but it sees substantial upside in seeking additional arrangements where it grants exclusive licenses for its brand, business model and member base.

“You see it in the numbers and the improved operating margin for the business as a whole; operating these regions as licensed businesses rather than company-owned, so to speak, is much more attractive for us,” CEO Holger Bartel told financial analysts in discussing the company’s first quarter results earlier this week. “And we are looking to see if there are some other markets or countries or regions where we can replicate that model.”

In 2020, Travelzoo reached a licensing agreement in Australia granting exclusive rights to use the Travelzoo brand in that country, as well as in New Zealand and Singapore. It generated just $8,000 in revenue from the deal in the quarter that ended March 31, but revenue from these deals lag a quarter, officials said. In 2020, it also struck a licensing deal in Japan.

“Licensing revenue is expected to increase going forward,” the company stated.

In other developments Travelzoo saw strength in North America in the first quarter, but the travel deals publisher saw Europe lagging.

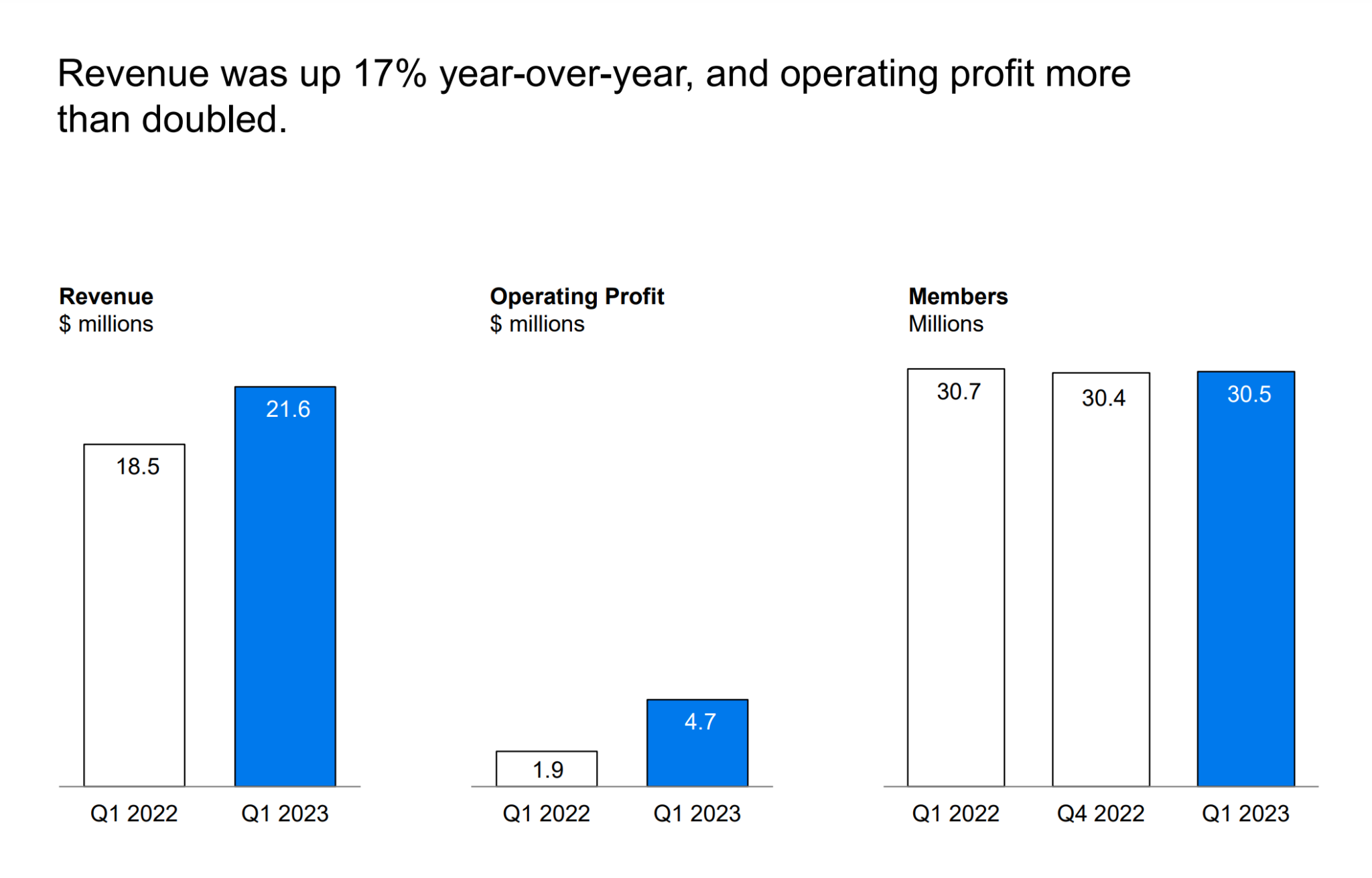

Travelzoo revenue increased 17 percent to $21.6 million in the first quarter compared with the same period in 2022. Net income rose 55 percent to $3.7 million.

North American segment revenue increased by 26 percent year-over-year to $14.8 million while European revenue was stable at $5.9 million.

“When we did the cash projection last year, we forecast that our cash balance will reach the lowest at the end of the fourth quarter 2022, and that’s exactly what happened,” said Bartel said. “Now it’s going up again…we expect the cash balance to continue to improve, and we’re happy that our net working capital is also improving. It’s a very good trend.”

Travelzoo had $19.8 million in cash and cash equivalents at the end of the first quarter.

Travelzoo year-to-year revenue data. Source: Travelzoo

“We will continue our strategy of leveraging Travelzoo’s global reach, trusted brand and strong relationships with top travel suppliers to negotiate more exclusive offers for Travelzoo members,” Bartel said in the prepared earnings announcement. “With more than 30 million members, 7.5 million mobile app users and 4 million social media followers, Travelzoo is loved by travel enthusiasts who are affluent, active, and open to new experiences.”

Travelzoo’s membership rolls — the people subscribing to its newsletters — ticked downward a tad to 30.5 million in the first quarter.

Bartel discussed the company’s plan to increase its member base as soon as possible.

“What you don’t really see that much in the numbers is that in Q1, we actually used the increased profitability to invest more in member acquisition,” Bartel said. “Our goal is to reach the number of members before the pandemic as quickly as possible and surpass that. So that’s one area where we are investing more, and we will continue to invest more because we want to bring member growth back as this is the best basis for future growth.”

Travelzoo’s quarterly earnings report stated the company believes it can maintain fixed costs at a relatively low level for the foreseeable future as revenue continues to grow.

The global media company’s cash balance remained consistent over the past year and merchant payables decreased by around $4.6 million.

Travelzoo’s management focus is to “reach and surpass pre-pandemic number of members and accelerate revenue growth, utilize higher operating margins to significantly increase EPS (earnings per share), grow Jack’s Flight Club’s profitable subscription revenue and launch Travelzoo META.”

Travelzoo teams in Southeast Asia and Australia have been working to source exclusive offers for members in North America and Europe.

Client acquisition in the form of deals offers in Maldives, Bali, Singapore and Thailand have also been well-received, according to Bartel.

“What’s driving interest in Travelzoo (is) the offers that we have,” Bartel said.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: earnings, metaverse, revenue strategy, Travelzoo

Photo credit: A file photo of travelers in Bora Bora. Source: Eric Stoen/Travel Babbo/Travelzoo Eric Stoen / Travel Babbo/Travelzoo