U.S. hotel performance has continued to inch toward normalized levels over the past three-plus quarters. The trend of normalization is evident across most data segments, but in recent months, particular attention has been drawn to group business.

Even with slightly higher supply in the market, group occupancy grew year over year in each month of 2023 except for December. The gains were primarily driven by the corporate sector, as the level of rooms occupied by group blocks (10 or more bookings) rose 12 percent on weekdays (Monday–Wednesday), 6 percent on shoulder days (Sunday and Thursday), and just 2 percent on weekends (Friday–Saturday). The lower growth rate on weekends was due to the absence of pent-up leisure demand (weddings and other social gatherings) that was still lifting the group metrics in 2022.

Flip the calendar to 2024, group occupancy increased 7.2 percent in January. At the same time, occupancy for the transient segment (bookings of less than 10 rooms) dipped 0.6 percent after growing for almost all of 2023. As a result, group ADR grew above the rate of inflation, at 4.5 percent, while transient ADR growth remained stalled.

When looking at day-of-week patterns, January’s shoulder days (+13 percent) and weekdays (+7 percent) once again outpaced the weekend (+1 percent) in group occupancy growth.

Improvements in weekday group demand also correlated with January’s F&B revenues, as all F&B line items showed year-over-year improvements. Revenues were up across the board in F&B departments, with line items like services charges and banquets & catering showing the most growth from last year.

From preliminary data in February, group occupancy was still growing, albeit at a slower pace (+4.6 percent). Still, weekdays (+8 percent) and shoulders (+5 percent) were growth standouts, while weekend group occupancy (–1 percent) declined.

Even with the recent slowing, group ADR growth has not been softening, coming in at an average of +5.7 percent over the past nine weeks. In the last full week of February, 15 of the Top 25 Markets saw year-over-year group occupancy gains, with Oahu and Las Vegas posting double-digit ADR increases.

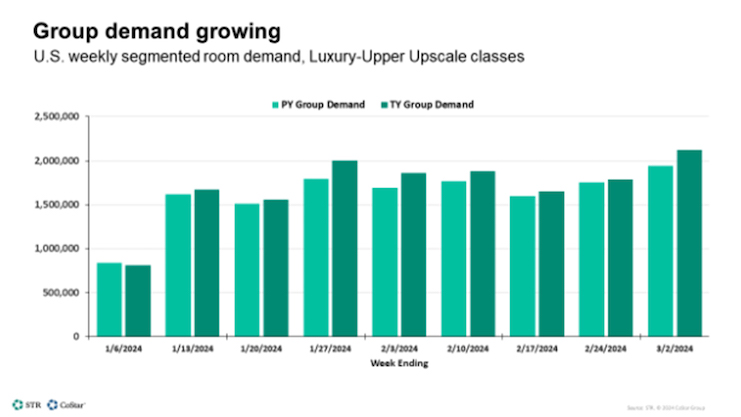

At the time of this writing, group demand had grown year over year for eight of nine weeks of 2024. Demand works for weekly comparisons between years, whereas occupancy was used for year-over-year comparison of months because of differing calendar compositions. For example, November 2023 included four Tuesdays—a common group business night—whereas November 2022 included five.

STR’s weekly data (ending March 2) showed a 9.1 percent year-over-year increase in U.S. weekly group demand, which also surpassed the 2019 comparable by 1.9 percent. Group ADR also continued to grow, holding above 5 percent growth for the fourth consecutive week. Almost all the group demand growth occurred in the Top 25 Markets, where group occupancy was up 11 percent. All other markets showed an increase of 1.4 percent. Eleven of the Top 25 Markets exceeded the 11 percent average, including Las Vegas, Houston, Dallas, Seattle, Orlando, San Francisco, Miami, Los Angeles, New York City, and Orange County (Anaheim). The strength of group demand will remain of particular interest throughout the spring season as we analyze the health of the industry.