Skift Take

We web-scraped 20k+ hotels listed on Google across the U.S., Europe, Asia and Middle East to understand which online travel agencies and direct sites compete for bookings in Google's sponsored and organic listings.

Skift Research’s latest report analyzes the distribution channels bidding for hotel bookings on the largest and most comprehensive metasearch engine in travel: Google Hotels.

We web-scraped more than 20,000 hotel listings across the U.S., Europe, Asia Pacific and Middle East & Africa. And we collected more than 520,000 data points to see which online travel agencies (OTAs) and direct sites are bidding for bookings and at what prices.

We scraped data across both Google’s sponsored results (paid listings) and Google’s recently introduced organic auction (where any site can list for free with the aid of a tech partner).

Read the full report for methodology and insights from this unique and proprietary web-scraping analysis of Google Hotels. Below we present a few of our key findings.

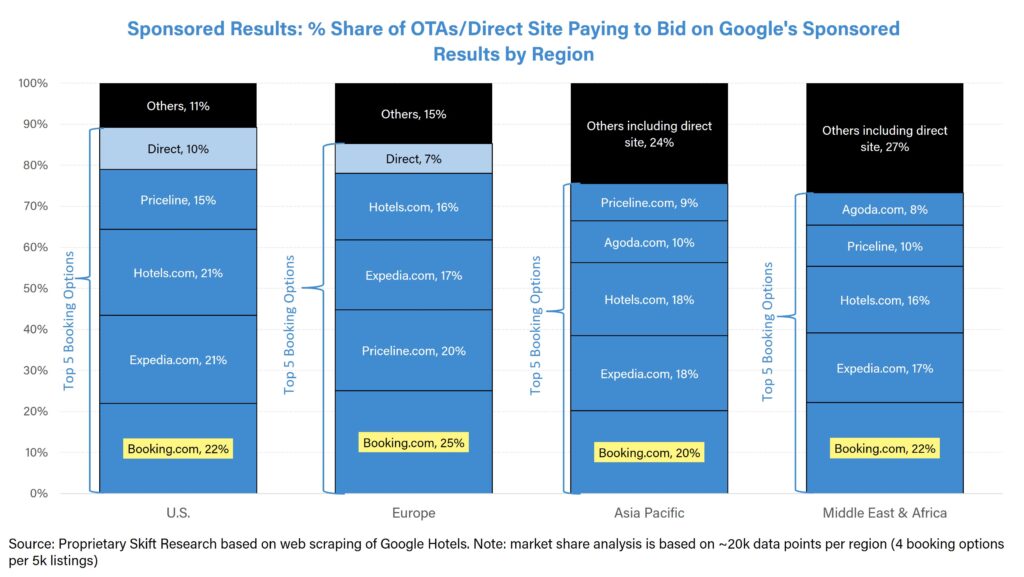

Booking Holdings and Expedia Group dominate Google’s sponsored results in every region, with Booking.com bidding the most out of any OTA

Booking.com is the dominating presence across Google’s sponsored results, paying to appear most often in every region. Of the top five most visible booking options in every region, Booking and Expedia through their sub-brands (such as Booking’s Priceline.com and Agoda.com and Expedia’s Hotels.com) have outbid any local players.

Expedia.com is spending advertising dollars to be top-of-list option in Google’s sponsored results

Even though Booking.com appears most frequently across all sponsored results in every region, Expedia.com is investing ad dollars to be the top-of-the-list option.

It’s a clear bid to outcompete Booking.com, particularly in regions such as Asia Pacific and Middle East & Africa, which are outside both Booking and Expedia’s respective home markets (Europe for Booking and the U.S. for Expedia).

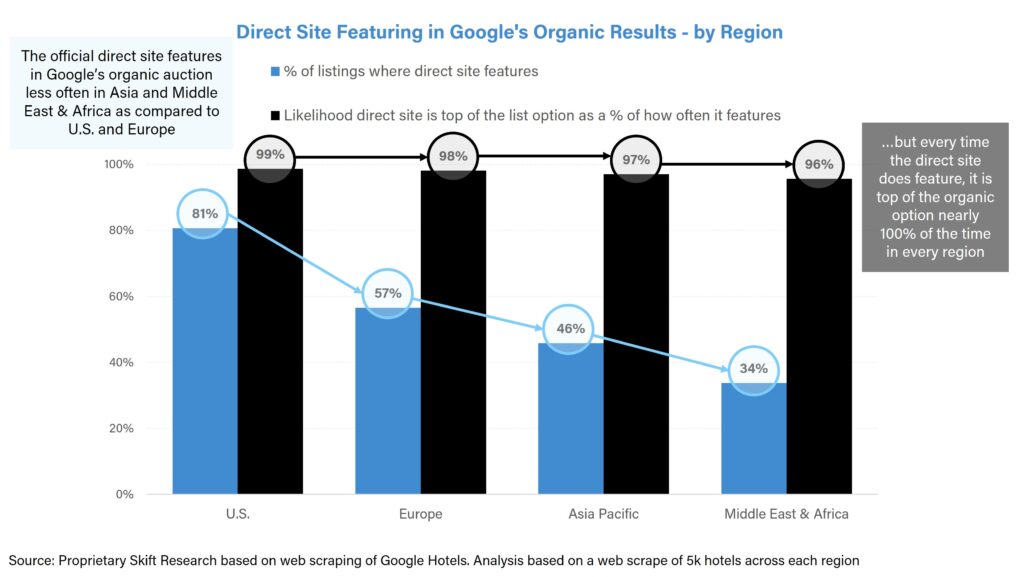

Google’s organic auction prioritizes the direct site in every region

Direct sites appear in Google’s organic auction less often in Asia and the Middle East & Africa as compared to the U.S. and Europe. This is generally due to a more fragmented, un-branded underlying hotel supply in the East compared to the West, with independent hotels having a greater reliance on OTAs for distribution.

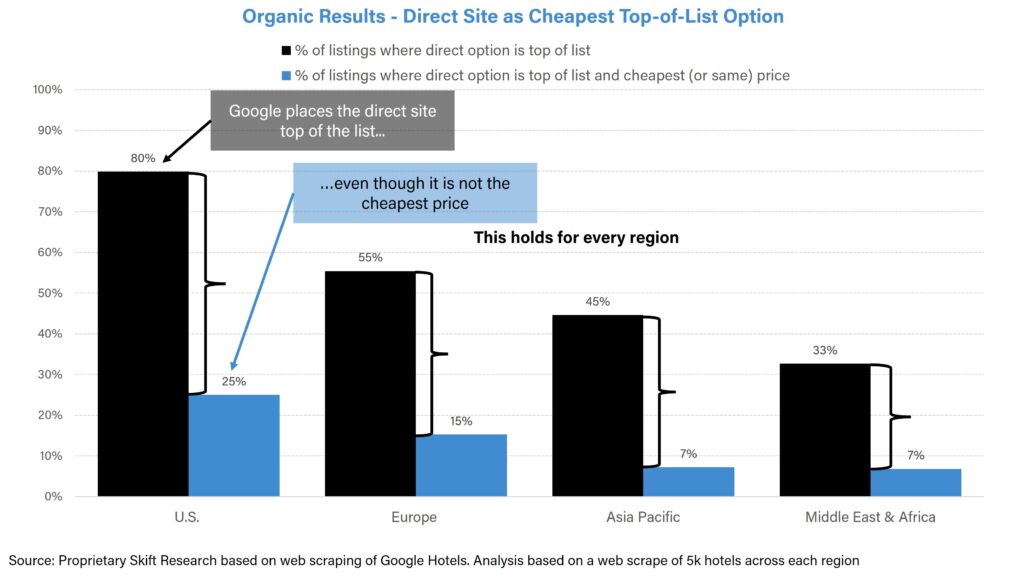

However, when direct sites do feature, Google prioritizes them to the top of the list nearly 100% of the time.

We can see that Google is actively prioritizing the direct site over the OTAs even though it is far from being the cheapest price – this is true in every region. This shows the role Google is playing in aiding the shift to direct bookings.

We write about the rise of direct bookings in detail in a recent Skift Research report: The Past, Present, and Future of Online Travel.

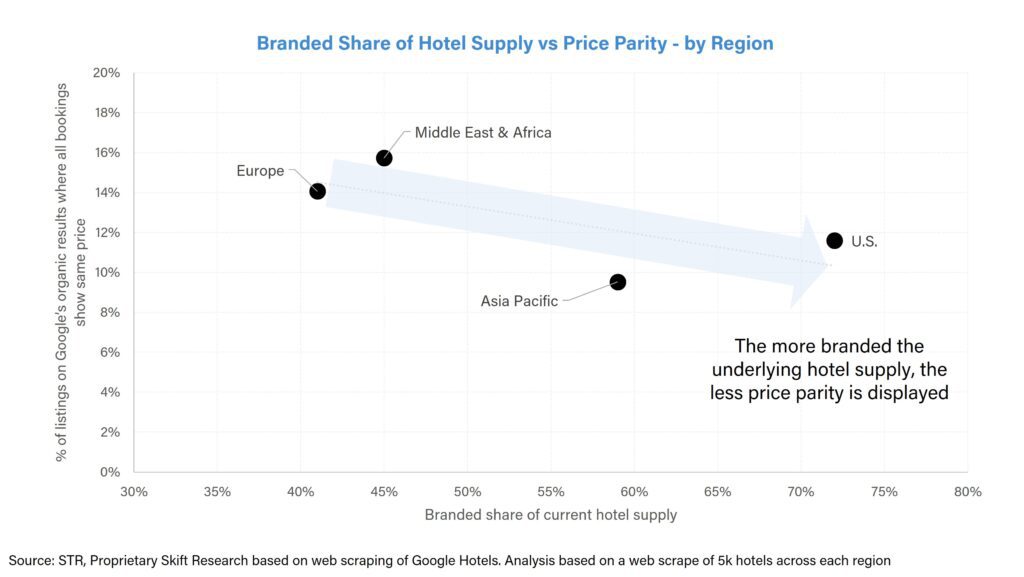

The more branded the underlying hotel supply, the lower the price parity displayed

Google’s organic results show that hotels in Europe and the Middle East & Africa display greater price parity (i.e. showing the same price across the various distribution channels per hotel listing) as compared to Asia Pacific and the U.S.

Compared to smaller independent hotels that make up a larger share of hotel supply in Europe and Middle East & Africa, the large branded chains in the U.S. have the power of scale to negotiate their contracts with the OTAs such that they can provide exclusive rates through their loyalty programs.

Read the full report for further in-depth analysis of our web-scraping of Google Hotels. Above we have presented only five charts of the 30+ charts which can be found in the full report, amongst other key insights.

What You’ll Learn From This Report

- Unique and proprietary analysis based on web scraping of over 20,000 hotels listed on Google across the U.S., Europe, Asia Pacific and Middle East & Africa

- A comparison of which OTAs are bidding on Google’s sponsored (paid) and organic (free) results across each region

- Analysis of the underlying hotel industry in each region – branded vs independent hotel supply mix, and market share of OTAs vs direct site

- Analysis of marketing spend efficiency from Booking and Expedia on sponsored results

- Price Parity across distribution channels in each region

Suggestions for further analysis of this rich dataset? Get in touch with author Pranavi Agarwal on LinkedIn or by email on [email protected].

This is the latest in a series of research reports, analyst sessions, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision-maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

Subscribe now to Skift Research Reports

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report à la carte at a higher price.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: booking, booking holdings, booking.com, distribution, expedia, expedia.com, google, online travel newsletter, otas, priceline, skift research, trip.com

Photo credit: Google Logo/Unsplash