Skift Take

Young Americans are shunning online travel giants like Expedia and Booking.com in favor of credit card travel portals, such as Chase Travel and Capital One Travel, a Skift Research survey found.

Would you book your next vacation through the reservation platform of your bank credit card, such as Chase Travel or Capital One? Would you turn instead to online travel agencies like Expedia and Booking.com? Or would you book directly with airlines and hotels?

If you’re an American under 35, the likely answer is that you favor your bank credit card’s travel portal, according to Skift Research.

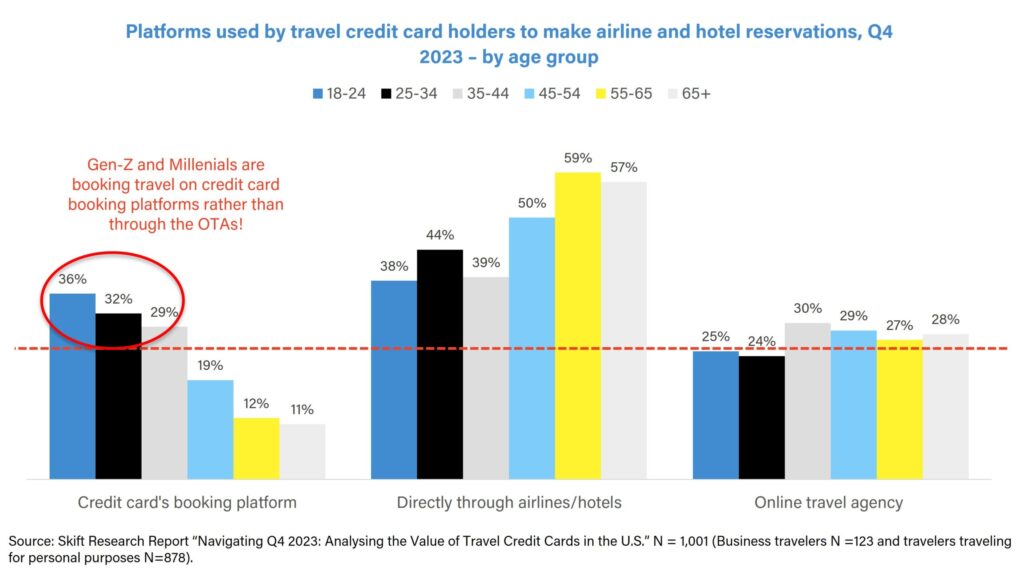

A Skift Research survey found that roughly a third of U.S. Gen-Zs and Millennials book airline and hotel reservations through credit card platforms, while only a quarter use online travel agencies.

This behavior is the opposite for older travelers, who are much likelier to use online travel agencies than credit card portals.

A Rising Generation Opts for Next-Gen Travel Players

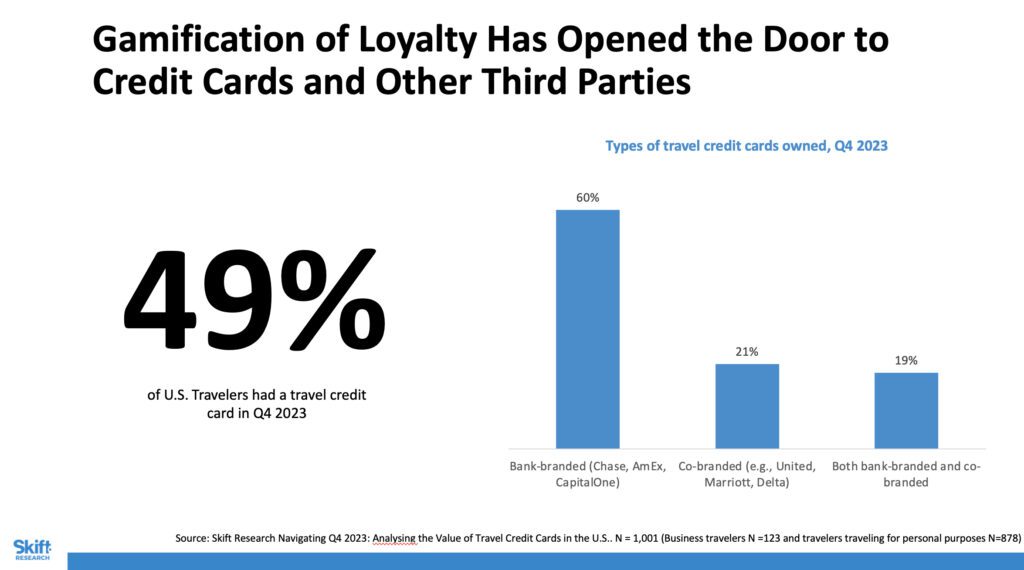

Skift Research surveyed 1,001 U.S. travel credit card holders who had taken at least one long-distance, overnight trip in late 2023. The survey was fielded online by a trusted third-party consumer panel provider.

The survey found that between 32% and 36% of travelers between the ages of 18 and 34 booked trips through credit card reservation portals, using their credit cards to either pay or redeem rewards. Between 24% and 25% booked trips through online travel agencies.

The preference for credit card portals was reversed for older travelers. People over the age of 55 booked through online travel agencies about 27% of the time, but they used credit card platforms only about 11% to 12% of the time.

Between 40% and 60% of travelers of all ages said they booked directly.

Online Travel Companies Still Benefit

The bank-led programs have grown quickly. JPMorgan Chase & Co. began pushing its Chase Travel portal to its U.S. customers in earnest in 2022. Last year, Chase Travel processed roughly $10 billion in transactions, making it roughly comparable in volume to established players like American Express Travel. Capital One Travel has similarly grown by leaps and bounds since its 2021 relaunch.

However the credit card travel booking portals source most of their inventory through business-to-business contracts with online travel giants. So companies like Expedia, Booking Holdings, and Hopper still make commissions by providing white-labeled plane tickets and hotel reservations to these banking partners.

It could be a perilous game for online travel giants to let upstart banking players create customer loyalty and habits among young travelers. Agencies’ commissions from powering the bank portals behind the scenes are typically less — and often 50% less — than when customers book at agencies themselves.

If a generational shift in booking patterns holds long-term, it could eventually undermine the margins of online travel companies.

More from Skift Research

Travel Tech Sector Stock Index Performance Year-to-Date

What am I looking at? The performance of travel tech sector stocks within the ST200. The index includes companies publicly traded across global markets including online travel, booking, and travel tech companies.

The Skift Travel 200 (ST200) combines the financial performance of nearly 200 travel companies worth more than a trillion dollars into a single number. See more travel tech sector financial performance.

Have a confidential tip for Skift? Get in touch

Photo credit: Some of the Chase Sapphire credit cards used for booking travel and other things. Source: Chase.